If you ask the experts – 2011 is going to be a good year for the auto industry. Now of course, our standards of “good” have evolved over the last 5 years, but nevertheless, the auto industry is happy to look into the New Year.

In 2008, new car sales saw their worst year since 1992 with total US Sales of 13,139,058. In 2009, sales dropped even 21% lower with total US sales of 10.4 million – reaching a 27-year low. In 2010, sales climbed back up to 11.5 million and 2011 is looking even brighter. JD Power & Associates predicts that US auto sales will climb to around 13 million units and some JD analysts have even said 15 million. This is great news!

In 2008, new car sales saw their worst year since 1992 with total US Sales of 13,139,058. In 2009, sales dropped even 21% lower with total US sales of 10.4 million – reaching a 27-year low. In 2010, sales climbed back up to 11.5 million and 2011 is looking even brighter. JD Power & Associates predicts that US auto sales will climb to around 13 million units and some JD analysts have even said 15 million. This is great news!

There are a number of things that play into these optimistic predictions. One factor is that 60% of the leases expiring in 2011 are held by borrowers in the “super prime” category – meaning that their credit scores are 780 and above, this is considered very good. With expiring leases and great credit scores, experts anticipate that these people will either buy the car they are leasing or buy something new before the year ends. This is promising for both the auto industry and lenders too. Not to mention, another 30% of expiring leases are held by borrowers with “near prime” credit scores. “Near prime” borrowers have scores above 620. This means that consumers who will have no trouble finding financing in 2011 hold 90% of all expiring leases. (Source: Las Vegas Review Journal)

Not only will the “super prime” and “near prime” borrowers see some love this year, but the lower credit score borrowers will as well. According to BankRate.com, the “sub prime” auto loan market is showing signs of life. “Sub prime” borrowers find themselves with weaker credit histories and credit scores below 620. BankRate explains that this market will expand in 2011 – creating opportunities for even more consumers to borrow for new car purchases. In the third quarter of 2010, new vehicle loans for credit-challenged buyers were already up 12.7%. Lending is looking to be much more tangible for most in 2011.

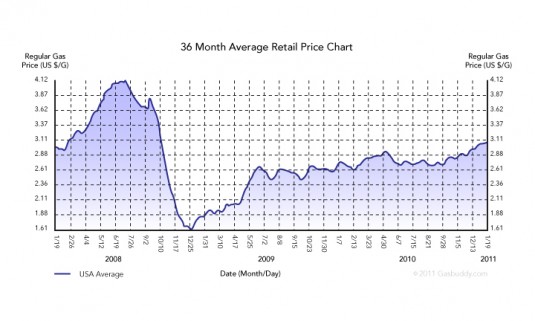

With car loans more available and more consumers in the market for new cars this year – we can remain optimistic. What we cannot remain optimistic about is the price of gasoline. Over the past three years we have seen gas prices fluctuate – with the national average reaching $4.12/gallon in 2008. Early 2009 teased us with prices remaining under $2/gallon. And now, our future doesn’t seem so bright. According to John Hofmeister, former Shell executive, Americans could be paying $5 a gallon by 2012. What does this mean for the auto industry? They must adapt. And adapt, they have. One of the answers: Hybrids. The Hybrid market is seeing fireworks in their future as more and more consumers are looking for vehicles that do not 100% depend on gasoline. Industry leaders expect Hybrid car sales to rise by 35% from 2010 to 2011. Although their overall sales have been down, the Hybrid market is still going strong and growing. The basic principles of supply and demand explain how the continued increase in Hybrid purchases has been enough to bring the price down and make Hybrids a competitor in the general auto industry. (Graph by: GasBuddy.com)

What we cannot remain optimistic about is the price of gasoline. Over the past three years we have seen gas prices fluctuate – with the national average reaching $4.12/gallon in 2008. Early 2009 teased us with prices remaining under $2/gallon. And now, our future doesn’t seem so bright. According to John Hofmeister, former Shell executive, Americans could be paying $5 a gallon by 2012. What does this mean for the auto industry? They must adapt. And adapt, they have. One of the answers: Hybrids. The Hybrid market is seeing fireworks in their future as more and more consumers are looking for vehicles that do not 100% depend on gasoline. Industry leaders expect Hybrid car sales to rise by 35% from 2010 to 2011. Although their overall sales have been down, the Hybrid market is still going strong and growing. The basic principles of supply and demand explain how the continued increase in Hybrid purchases has been enough to bring the price down and make Hybrids a competitor in the general auto industry. (Graph by: GasBuddy.com)

The auto industry can look forward to increased sales. Auto loan lenders can look forward to more borrowers. The Hybrid market can anticipate continued growth. And we, the consumers, can look forward to more available loans, competitively priced Hybrid vehicles and a future filled with innovation.

This should be a bright year for the auto industry.

Share:

Recent Posts

- 9/22/2016 • Magneto Creates M Financial’s 2015 Annual Report

- 8/03/2016 • Magneto aligns Marger Johnson’s look with the industries it serves

- 7/20/2016 • Magneto brings bold vision to City Color branding and website development

- 7/13/2016 • Brand Advertising, Defined: The Creative Process

- 5/25/2016 • Brand Advertising, Defined: Where Science Meets Art